Benefits of Filling Form W-7 Online

In a world that's increasingly going digital, handling paperwork like tax forms can seem daunting. This article aims to simplify understanding of the process involved with the IRS W7 form in fillable PDF format. Let's begin by figuring out what IRS Form W7 is.

Understanding the IRS Form W7

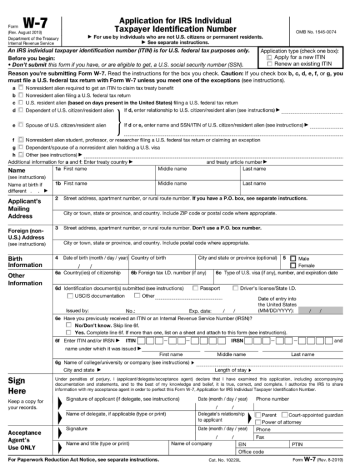

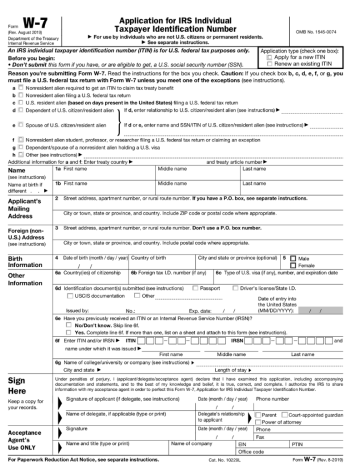

Form W-7 is a crucial document administered by the Internal Revenue Service (IRS) to assign an Individual Taxpayer Identification Number (ITIN). This unique identifier serves individuals who are ineligible for a Social Security Number but still need to fulfill their federal tax obligations in the United States. Importantly, it caters to both U.S. residents and non-residents.

For non-U.S. residents, the ITIN obtained through Form W-7 plays a pivotal role in ensuring compliance with U.S. tax regulations, allowing them to file tax returns, claim tax benefits, and meet their financial obligations. This process is especially important for individuals who earn income in the United States, such as international students, foreign workers, or individuals with investments in the country.

Features of the Fillable W-7 Form

Traditional applications can be tedious and time-consuming to fill, submit, and process. On the other hand, the fillable IRS Form W7 offers multiple benefits:

- it's accessible from anywhere with an internet connection.

- the online version is easy to navigate, and drop-down menus help to complete the template accurately.

- these features significantly reduce errors that may lead to processing delays.

Challenges Using the W7 Fillable Form Online

While the convenience of the digital template is highly beneficial, users can confront a few challenges when handling the IRS Form W7 fillable online. A lack of digital literacy may result in difficulty filling out the application. Furthermore, technical issues could potentially impede the submission or storage of the form. It's important to be patient and have a basic understanding of digital forms to avoid such problems.

W-7 Online Form: Protecting Personal Information

When submitting sensitive information online, such as using the IRS W7 fillable form, it is crucial to take steps to ensure data protection. There are a few recommendations to follow in this regard.

- First, always use a secure network - avoid submitting forms over public or unsecured Wi-Fi.

- Second, utilize theft-protection software.

- Third, always log out after completing your copy. It's always better to err on the side of caution while handling sensitive information online.

We hope this guide helps ease the process of handling the IRS fillable W-7 form in 2023. Remember, accurate and timely submission can drastically eliminate unnecessary difficulties during the tax filing process.

Related Forms

-

![image]() W-7 Form W-7 is a crucial document issued by the Internal Revenue Service (IRS) in the United States. Generally, the W-7 tax form is an application for those who need to get an Individual Taxpayer Identification Number (ITIN). The ITIN allows the IRS to process taxes for individuals who aren't eligible for a Social Security Number. Fill Now

W-7 Form W-7 is a crucial document issued by the Internal Revenue Service (IRS) in the United States. Generally, the W-7 tax form is an application for those who need to get an Individual Taxpayer Identification Number (ITIN). The ITIN allows the IRS to process taxes for individuals who aren't eligible for a Social Security Number. Fill Now -

![image]() Printable Form W-7 To handle any form efficiently, understanding its structure is fundamental. And the IRS W-7 printable form in PDF falls into this category. It is a legal document the IRS requests to apply for an Individual Tax Identification Number (ITIN). This form comprises several sections, each comprising distinct data you must fill out accurately. Major sections include personal information, foreign domicile, and reasons for ITIN application. From the dot-filled boxes for your name and contact details to the checkbox section for ITIN usage reasons, the W7 form layout ensures a seamless filing experience. Consider every field as a building block contributing to making the entire form load process easier and faster. Guidelines to Fill Out Form W-7 Accurately In pursuit of correct filing, let's go through a few guidelines that can help you fill out the W7 form printable for free without error. They are as follows: Ensure requested demographic details such as name, birth date, mailing address, and country of citizenship are accurately filled. In the section requesting your foreign address, enter all essential details if you hold a residence outside of the U.S. Thoroughly tick the appropriate boxes that reflect why you are applying for an ITIN. Be sure to provide supporting documentation that verifies your foreign status and true identity. Going through these bullets helps you tackle the form efficiently, minimizing the chances of error and application rejection. The Form W-7 Submitting Process Once properly filled, submitting the printable Form W-7 is the final step. Follow the instructions: first, double-check all information on your form; second, sign and date the copy; finally, you are to either mail the form along with required supporting documentation to the IRS, or you can submit it in person at an IRS walk-in office. Please note that sending your original documents via mail could be risky. Hence, it is often advised to present the form in person if possible. The IRS W-7 Form Submission Timelines Deadlines can often trigger anxiety. However, understanding timeline specifics for different forms can help dispel such discomfort. Remarkably, there is a breath of relief with Form W-7 - it doesn't actually have a strict deadline! You are required to submit it at the time of your federal tax return. Are you planning to file your W7 form for 2023 printable copy? Don't fret; just ensure you submit it together with your tax return for the respective tax year. Rounding up, understanding the W7 form in PDF printable, how to fill it correctly, and the submission process go a long way in ensuring a smooth tax filing process. Remember, even the most complex tasks can become comfortable with the proper knowledge. Fill Now

Printable Form W-7 To handle any form efficiently, understanding its structure is fundamental. And the IRS W-7 printable form in PDF falls into this category. It is a legal document the IRS requests to apply for an Individual Tax Identification Number (ITIN). This form comprises several sections, each comprising distinct data you must fill out accurately. Major sections include personal information, foreign domicile, and reasons for ITIN application. From the dot-filled boxes for your name and contact details to the checkbox section for ITIN usage reasons, the W7 form layout ensures a seamless filing experience. Consider every field as a building block contributing to making the entire form load process easier and faster. Guidelines to Fill Out Form W-7 Accurately In pursuit of correct filing, let's go through a few guidelines that can help you fill out the W7 form printable for free without error. They are as follows: Ensure requested demographic details such as name, birth date, mailing address, and country of citizenship are accurately filled. In the section requesting your foreign address, enter all essential details if you hold a residence outside of the U.S. Thoroughly tick the appropriate boxes that reflect why you are applying for an ITIN. Be sure to provide supporting documentation that verifies your foreign status and true identity. Going through these bullets helps you tackle the form efficiently, minimizing the chances of error and application rejection. The Form W-7 Submitting Process Once properly filled, submitting the printable Form W-7 is the final step. Follow the instructions: first, double-check all information on your form; second, sign and date the copy; finally, you are to either mail the form along with required supporting documentation to the IRS, or you can submit it in person at an IRS walk-in office. Please note that sending your original documents via mail could be risky. Hence, it is often advised to present the form in person if possible. The IRS W-7 Form Submission Timelines Deadlines can often trigger anxiety. However, understanding timeline specifics for different forms can help dispel such discomfort. Remarkably, there is a breath of relief with Form W-7 - it doesn't actually have a strict deadline! You are required to submit it at the time of your federal tax return. Are you planning to file your W7 form for 2023 printable copy? Don't fret; just ensure you submit it together with your tax return for the respective tax year. Rounding up, understanding the W7 form in PDF printable, how to fill it correctly, and the submission process go a long way in ensuring a smooth tax filing process. Remember, even the most complex tasks can become comfortable with the proper knowledge. Fill Now -

![image]() W-7 ITIN Form The Internal Revenue Service (IRS) issues an Individual Taxpayer Identification Number (ITIN) to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number. The ITIN is a nine-digit number issued by the IRS to such individuals. To obtain an ITIN, one has to accomplish and submit IRS Form W7. Grasping the ITIN IRS Form W7 can take a bit of work, but we're here to help. IRS Form W-7 & Recent Changes Implemented Over time, the IRS has made a number of changes to Form W-7 to make it easier for taxpayers to complete. These alterations revolve around the requirements for supporting documents and how applicants can submit the form. Pay attention that the W-7 ITIN form instructions are updated periodically, and it's important to follow the most recent guidelines to avoid delays or rejections. ITIN W-7 Application: Who Qualifies and Who Doesn't? In discussing who can and cannot apply for ITIN with IRS ITIN W7, we must know that the IRS issues ITINs to foreign nationals and others with federal tax reporting or filing requirements who do not qualify for SSNs. The IRS does not consider immigration status when assigning ITINs. This renders many people eligible to apply, including foreign students, resident and nonresident aliens, spouses and dependents of U.S. citizens, or resident aliens, amongst other groups. Remember to refer to the ITIN W7 instructions if you still have questions or if your situation is not usual. Tax Benefits and Implications of Having an ITIN An ITIN, in conjunction with submitting Form W-7, can offer several tax-related advantages. For instance, it enables individuals to file taxes and abide by U.S. tax laws, even if they do not have an SSN. Obtaining an ITIN doesn't automatically alter an individual's immigration status. However, it provides a vital avenue for those not eligible for a Social Security Number (SSN) to fulfill their tax obligations and, consequently, adhere to U.S. tax laws and regulations. This distinction is crucial as it allows individuals, including non-U.S. residents, to comply with tax laws and avoid potential legal complications. It's worth noting that while an ITIN facilitates tax compliance, it does not confer any changes to an individual's immigration status or grant any additional rights or benefits in that regard. Instead, its primary purpose is to enable accurate tax reporting and payment, ensuring those without an SSN can fully meet their tax obligations. Furthermore, the IRS strongly emphasizes safeguarding the privacy of ITIN applicants and existing holders. According to the Form W-7 and ITIN instructions, there is a strict policy of not sharing TIN applicant details with immigration agencies. This privacy assurance is designed to encourage individuals to apply for an ITIN without fear of any adverse immigration-related consequences, providing them with a sense of security and confidence in the application process. Fill Now

W-7 ITIN Form The Internal Revenue Service (IRS) issues an Individual Taxpayer Identification Number (ITIN) to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number. The ITIN is a nine-digit number issued by the IRS to such individuals. To obtain an ITIN, one has to accomplish and submit IRS Form W7. Grasping the ITIN IRS Form W7 can take a bit of work, but we're here to help. IRS Form W-7 & Recent Changes Implemented Over time, the IRS has made a number of changes to Form W-7 to make it easier for taxpayers to complete. These alterations revolve around the requirements for supporting documents and how applicants can submit the form. Pay attention that the W-7 ITIN form instructions are updated periodically, and it's important to follow the most recent guidelines to avoid delays or rejections. ITIN W-7 Application: Who Qualifies and Who Doesn't? In discussing who can and cannot apply for ITIN with IRS ITIN W7, we must know that the IRS issues ITINs to foreign nationals and others with federal tax reporting or filing requirements who do not qualify for SSNs. The IRS does not consider immigration status when assigning ITINs. This renders many people eligible to apply, including foreign students, resident and nonresident aliens, spouses and dependents of U.S. citizens, or resident aliens, amongst other groups. Remember to refer to the ITIN W7 instructions if you still have questions or if your situation is not usual. Tax Benefits and Implications of Having an ITIN An ITIN, in conjunction with submitting Form W-7, can offer several tax-related advantages. For instance, it enables individuals to file taxes and abide by U.S. tax laws, even if they do not have an SSN. Obtaining an ITIN doesn't automatically alter an individual's immigration status. However, it provides a vital avenue for those not eligible for a Social Security Number (SSN) to fulfill their tax obligations and, consequently, adhere to U.S. tax laws and regulations. This distinction is crucial as it allows individuals, including non-U.S. residents, to comply with tax laws and avoid potential legal complications. It's worth noting that while an ITIN facilitates tax compliance, it does not confer any changes to an individual's immigration status or grant any additional rights or benefits in that regard. Instead, its primary purpose is to enable accurate tax reporting and payment, ensuring those without an SSN can fully meet their tax obligations. Furthermore, the IRS strongly emphasizes safeguarding the privacy of ITIN applicants and existing holders. According to the Form W-7 and ITIN instructions, there is a strict policy of not sharing TIN applicant details with immigration agencies. This privacy assurance is designed to encourage individuals to apply for an ITIN without fear of any adverse immigration-related consequences, providing them with a sense of security and confidence in the application process. Fill Now -

![image]() W7 Application Instructions Welcome to our handy guide to simplifying the process of tax filing. Today, we're homing in on the IRS Form W-7. This form can feel a little daunting if you are unfamiliar with it, but don't worry - we're here to help! Let's dive into what it is, when you might need it, and, most importantly, the instructions for IRS Form W-7. IRS Form W-7 Basics The purpose of IRS Form W-7, also known as the Application for IRS Individual Taxpayer Identification Number, is to help non-U.S. residents or their dependents obtain an individual taxpayer identification number (ITIN). The ITIN allows them to file taxes with the Internal Revenue Service. It's necessary to use this form if you don't have, or aren't eligible for, a Social Security Number (SSN) but need to report federal tax. Some foreign students and scholars may also need to fill out Form W-7. Dealing With Blank Form W-7: Key Elements Here are some vital considerations while going through the W7 application instructions: The form requires you to provide your name, mailing address, foreign address (if applicable), birth information, and country of citizenship. Choose a suitable reason for applying from the options provided in the form. If you've used an ITIN or SSN before, you need to provide this information, too. Don’t forget to sign and date the form. ITIN Form W-7 & Common Mistakes Following the exact W7 filing instructions is crucial, as minor errors can lead to delays or even rejection of your application. Given below are some common mistakes people make, along with tips to avoid them: Not providing the full nameYour full legal name should match the one on your proof of identity documents. Forgetting to sign/dateThe application is valid only if it is signed and dated. Errors in addressInclude a complete and correct mailing address. Your application may be returned or denied if the address is incorrect or incomplete. Mistakes are a part of the learning process, but when it comes to tax forms, they can cost precious time. Let's stay one step ahead by giving careful attention to the U.S. Form W7 instructions for 2023 and ensuring a hassle-free experience. The Journey to Completion Believe it or not, we're nearing the end of the journey. Yes, dealing with taxes can be tough, but hopefully, this simple guide has made the process a bit smoother. When closely following the instructions for the W-7 form, you're all set for a successful filing. Remember, taxes don’t have to be taxing, especially when you are properly equipped and informed. Happy filing, and until next time! Fill Now

W7 Application Instructions Welcome to our handy guide to simplifying the process of tax filing. Today, we're homing in on the IRS Form W-7. This form can feel a little daunting if you are unfamiliar with it, but don't worry - we're here to help! Let's dive into what it is, when you might need it, and, most importantly, the instructions for IRS Form W-7. IRS Form W-7 Basics The purpose of IRS Form W-7, also known as the Application for IRS Individual Taxpayer Identification Number, is to help non-U.S. residents or their dependents obtain an individual taxpayer identification number (ITIN). The ITIN allows them to file taxes with the Internal Revenue Service. It's necessary to use this form if you don't have, or aren't eligible for, a Social Security Number (SSN) but need to report federal tax. Some foreign students and scholars may also need to fill out Form W-7. Dealing With Blank Form W-7: Key Elements Here are some vital considerations while going through the W7 application instructions: The form requires you to provide your name, mailing address, foreign address (if applicable), birth information, and country of citizenship. Choose a suitable reason for applying from the options provided in the form. If you've used an ITIN or SSN before, you need to provide this information, too. Don’t forget to sign and date the form. ITIN Form W-7 & Common Mistakes Following the exact W7 filing instructions is crucial, as minor errors can lead to delays or even rejection of your application. Given below are some common mistakes people make, along with tips to avoid them: Not providing the full nameYour full legal name should match the one on your proof of identity documents. Forgetting to sign/dateThe application is valid only if it is signed and dated. Errors in addressInclude a complete and correct mailing address. Your application may be returned or denied if the address is incorrect or incomplete. Mistakes are a part of the learning process, but when it comes to tax forms, they can cost precious time. Let's stay one step ahead by giving careful attention to the U.S. Form W7 instructions for 2023 and ensuring a hassle-free experience. The Journey to Completion Believe it or not, we're nearing the end of the journey. Yes, dealing with taxes can be tough, but hopefully, this simple guide has made the process a bit smoother. When closely following the instructions for the W-7 form, you're all set for a successful filing. Remember, taxes don’t have to be taxing, especially when you are properly equipped and informed. Happy filing, and until next time! Fill Now -

![image]() IRS Form W-7 in PDF Understanding tax forms well is crucial to ensure you obey the tax laws and avoid unnecessary penalties. One such document is the Form W-7 IRS. Because the tax system can get complex, we will guide you through the intricacies of the IRS Form W-7 in PDF format, making it easy to grasp. Terms for the W-7 Application Filling Several circumstances call for you to use a W-7 IRS form in PDF format. It's not only required by non-U.S. residents for tax purposes but also by others under special situations. For instance, suppose you are an international student with a scholarship or income from a U.S. source. In that case, you'll need to fill the W-7 PDF form. Another situation could be if you are a non-resident alien required to withhold U.S. taxes. For each of these situations, the best solution is to familiarize yourself with the form's requirements, fill in accurate details, and submit it on time. You can seek professional help if you find the process confusing. Correcting IRS Form W-7 Mistakes are inevitable, and during tax filing, they are not uncommon. If you commit an error while filling out the W-7 form in PDF, you needn't worry. Once you realize the mistake, correct it immediately by filling out a new form with accurate details and submit it promptly. Form W-7 for International Students: Navigating U.S. Tax Compliance For international students, U.S. tax compliance can seem daunting. That's where Form W-7 instructions in PDF format come in handy. This guide simplifies the process of filling out the form, ensuring a smoother tax compliance journey. Remember that your school's international office might offer assistance, and it's recommended to take advantage of such resources. ITIN Form W-7: Frequently Asked Questions Can I submit the W7 PDF form electronically?Absolutely, the IRS permits electronic submission of the W-7 form, making the process more convenient and efficient for applicants. Should I submit additional documentation with Form W-7?Yes, in addition to Form W-7, you are required to provide specific identity documentation as detailed in the comprehensive W-7 form instructions. This documentation is essential to establish and verify your identity. What is the penalty for late submission of the Form W-7?The penalties for late submission of Form W-7 can vary based on individual circumstances and the nature of the late filing. While the IRS may impose penalties, the exact consequences can differ. To avoid potential penalties, it's strongly recommended to submit your Form W-7 in a timely manner, meeting the specified deadlines for your particular situation. Timely filing helps ensure a smoother and more compliant application process. Fill Now

IRS Form W-7 in PDF Understanding tax forms well is crucial to ensure you obey the tax laws and avoid unnecessary penalties. One such document is the Form W-7 IRS. Because the tax system can get complex, we will guide you through the intricacies of the IRS Form W-7 in PDF format, making it easy to grasp. Terms for the W-7 Application Filling Several circumstances call for you to use a W-7 IRS form in PDF format. It's not only required by non-U.S. residents for tax purposes but also by others under special situations. For instance, suppose you are an international student with a scholarship or income from a U.S. source. In that case, you'll need to fill the W-7 PDF form. Another situation could be if you are a non-resident alien required to withhold U.S. taxes. For each of these situations, the best solution is to familiarize yourself with the form's requirements, fill in accurate details, and submit it on time. You can seek professional help if you find the process confusing. Correcting IRS Form W-7 Mistakes are inevitable, and during tax filing, they are not uncommon. If you commit an error while filling out the W-7 form in PDF, you needn't worry. Once you realize the mistake, correct it immediately by filling out a new form with accurate details and submit it promptly. Form W-7 for International Students: Navigating U.S. Tax Compliance For international students, U.S. tax compliance can seem daunting. That's where Form W-7 instructions in PDF format come in handy. This guide simplifies the process of filling out the form, ensuring a smoother tax compliance journey. Remember that your school's international office might offer assistance, and it's recommended to take advantage of such resources. ITIN Form W-7: Frequently Asked Questions Can I submit the W7 PDF form electronically?Absolutely, the IRS permits electronic submission of the W-7 form, making the process more convenient and efficient for applicants. Should I submit additional documentation with Form W-7?Yes, in addition to Form W-7, you are required to provide specific identity documentation as detailed in the comprehensive W-7 form instructions. This documentation is essential to establish and verify your identity. What is the penalty for late submission of the Form W-7?The penalties for late submission of Form W-7 can vary based on individual circumstances and the nature of the late filing. While the IRS may impose penalties, the exact consequences can differ. To avoid potential penalties, it's strongly recommended to submit your Form W-7 in a timely manner, meeting the specified deadlines for your particular situation. Timely filing helps ensure a smoother and more compliant application process. Fill Now