The IRS W-7 Form Primary Purpose

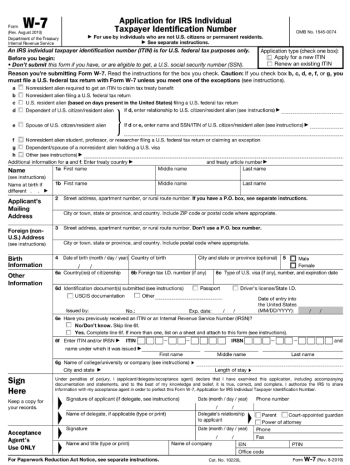

Form W-7 is a crucial document issued by the Internal Revenue Service (IRS) in the United States. Generally, the W-7 tax form is an application for those who need to get an Individual Taxpayer Identification Number (ITIN). The ITIN allows the IRS to process taxes for individuals who aren't eligible for a Social Security Number.

Our website, form-w7.net, is geared towards smoothing your tax filing process. It provides a free fillable W7 form that you can fill out comfortably on your own time. We understand that tax forms can be confusing, so we offer clear instructions and easy-to-understand examples. Additionally, for those who prefer to write their details manually, a blank W7 form is available. We aim to simplify the process and help you avoid any errors that could delay your tax processing. Trust our resources to make your tax filing less stressful and more efficient.

Eligibility to Fill Out Form W7 for ITIN

In a few words, the ITIN W-7 application form must be filed by individuals with a U.S. taxpayer identification number. But who are they? Let's figure it out with a fictional example, shall we?

Ana is a resident of Mexico, but she's been working remotely for a company based in the U.S. Even though she lives outside the U.S., she must fill out the W7 form because she has income from a U.S. source. Her employer deducts U.S. taxes from her salary, and to claim a refund or an exemption, she needs an ITIN (Individual Taxpayer Identification Number), which is submitted via the W-7.

Ana is a resident of Mexico, but she's been working remotely for a company based in the U.S. Even though she lives outside the U.S., she must fill out the W7 form because she has income from a U.S. source. Her employer deducts U.S. taxes from her salary, and to claim a refund or an exemption, she needs an ITIN (Individual Taxpayer Identification Number), which is submitted via the W-7.

Now, how does she do this? Ana can easily follow the IRS Form W-7 instructions on our page to complete this process successfully. So, Ana is abiding by tax rules and staying stress-free in her cozy Mexican home. Isn't that delightful?

Filling Out the W-7 Online Application

- Head over to our website and open the blank W-7 template in the PDF editor. If you prefer the manual filling, you can easily download Form W7 by clicking the arrow sign.

- Carefully study the template before filling it out. Make sure you understand each of the sections.

- Commence the process by inputting your personal and tax-related information into the designated fields. It is imperative to provide accurate and truthful details to prevent potential complications.

- Once all the required fields have been completed, take a moment to meticulously review each piece of information. This vital step guarantees that your submission is error-free and nothing vital has been omitted.

- Contact knowledgeable experts if any uncertainties or questions arise during this process. You can also look for extra help at the tax-related forums or online support.

- Once you're confident that everything is correct, it's time to send it off. You can file the W-7 form to the IRS directly through our website by hitting the 'Submit' button.

- If you want to file the printable application or just have a copy of the document for personal needs, print the W-7 form by clicking the "Printer" button.

Timelines for the W-7 IRS Form

Are you prepared to tackle your tax responsibilities? The sooner you start, the less stress you'll endure. It's essential to know that if you are applying for an Individual Tax Identification Number (ITIN), the ITIN Form W-7 is a necessary component you'll need to fill out. This particular document is available for submission throughout the entire year, ensuring you have ample time to complete it accurately and efficiently.

After sending your W-7 application to the Internal Revenue Service, you might be wondering, "How long till I hear back?" Typically, the IRS will get back to you within six weeks. You can even fill out your IRS Form W-7 online to make the process smoother and faster. However, don't be alarmed if it takes a little more time. They're doing their best to process your request as quickly as possible.

Blank W7 Form: Estimated Burden

Filling out your first IRS Form W7 in PDF might seem a bit stressful, but do not worry. In most cases, you'll only need around 20 to 30 minutes to complete this sample independently. Using the PDF version, which is easily available online, you need to fill in the required details carefully. But it's all quite simple; you'll input some personal information and follow the instructions provided. Just take it step by step, make sure you double-check everything, and soon you'll have it all ready to go. It's quicker than you think!

ITIN W-7 Application Form: People Also Ask

- Where can I find the IRS W7 form for download?You can easily access and download the IRS Form W-7 directly from our website. This document is completely free to access and download at any time. Click the "Get Form" button to open the document and look for the arrow sign to initiate the downloading process.

- How can I get the IRS W-7 form printable version?Once you have opened the template by following the link from our website, you have the option to print it directly. Just make sure that your printer settings are properly configured for a crisp, readable printout. Pay attention to the additional settings like the size and so on.

- What is the purpose of the IRS Form W-7: ITIN application?It's used to apply for an Individual Taxpayer Identification Number or ITIN. This number is absolutely necessary for individuals who are not eligible for an SSN but need to file taxes in the United States.

- Can I access the IRS W7 form in PDF?Yes, as a rule, all official documents are spread in PDF format. It's one of the most used formats with many benefits. This makes it easy for anyone to download, fill, and print the copy at their convenience.

- Does the W7 form for 2023 in PDF differ from the template for the previous year?The IRS typically updates its forms for the new tax year, but some templates stay valid for a few years, and the ITIN application is one of these examples. In 2023, the IRS didn't release the new template, but we keep an eye on its news to inform you about all the changes.

IRS W-7 Form: More Instructions & Examples

-

![image]() Printable Form W-7 To handle any form efficiently, understanding its structure is fundamental. And the IRS W-7 printable form in PDF falls into this category. It is a legal document the IRS requests to apply for an Individual Tax Identification Number (ITIN). This form comprises several sections, each comprising disti... Fill Now

Printable Form W-7 To handle any form efficiently, understanding its structure is fundamental. And the IRS W-7 printable form in PDF falls into this category. It is a legal document the IRS requests to apply for an Individual Tax Identification Number (ITIN). This form comprises several sections, each comprising disti... Fill Now -

![image]() IRS W7 Fillable Form In a world that's increasingly going digital, handling paperwork like tax forms can seem daunting. This article aims to simplify understanding of the process involved with the IRS W7 form in fillable PDF format. Let's begin by figuring out what IRS Form W7 is. Understanding the IRS Form W7 Form W-... Fill Now

IRS W7 Fillable Form In a world that's increasingly going digital, handling paperwork like tax forms can seem daunting. This article aims to simplify understanding of the process involved with the IRS W7 form in fillable PDF format. Let's begin by figuring out what IRS Form W7 is. Understanding the IRS Form W7 Form W-... Fill Now -

![image]() W-7 ITIN Form The Internal Revenue Service (IRS) issues an Individual Taxpayer Identification Number (ITIN) to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number. The ITIN is a nine-digit number issued by the IRS... Fill Now

W-7 ITIN Form The Internal Revenue Service (IRS) issues an Individual Taxpayer Identification Number (ITIN) to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number. The ITIN is a nine-digit number issued by the IRS... Fill Now -

![image]() W7 Application Instructions Welcome to our handy guide to simplifying the process of tax filing. Today, we're homing in on the IRS Form W-7. This form can feel a little daunting if you are unfamiliar with it, but don't worry - we're here to help! Let's dive into what it is, when you might need it, and, most importantly, the in... Fill Now

W7 Application Instructions Welcome to our handy guide to simplifying the process of tax filing. Today, we're homing in on the IRS Form W-7. This form can feel a little daunting if you are unfamiliar with it, but don't worry - we're here to help! Let's dive into what it is, when you might need it, and, most importantly, the in... Fill Now